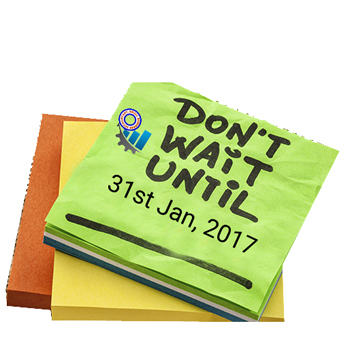

Small Business Tax Return Deadline. Don’t Miss It.

The clock is quickly ticking away on the small business tax return deadline. Only a few months left to ensure that your business affairs are in order. Please contact Small Business Accountant immediately if you are not confident enough to save your money on your tax bill.

If you require a self-assessment tax return, you must prepare your annual records before the end of the fiscal year. Also businesses and their owners should now be focusing on filing their online tax return. This must be with HM Revenue & Customs (HMRC) by midnight on 31 January 2017.

This date also marks the deadline for the final payment of any tax due to HMRC. Businesses and individuals must ensure that their affairs are in order or face significant penalties.

Failing to send your tax return could lead to severe penalties. Starting with a £100 automatic fine applied to all online tax returns if they are late by just one day.

After three months, any late returns will be subject to a penalty of £10 per day for each day the tax is due. It is up to a maximum of 90 days and a maximum of £900. You also have to pay interest on the outstanding tax. These fines will continue to build up if they are not resolved.

It is important to ensure all the details required to complete a self-assessment return are with an accountant ahead of the deadline so that they can prepare an accurate return.

This time of year is also an excellent time to review your affairs. Our Small Business Accountant will find the ways of minimising any liabilities through careful tax planning.

Why might you need an Accountant for small business tax return ?

Anyone can submit their own tax return online. But everyone does not know how to claim certain expenses and what to declare and when that reduce his tax liabilities. Submitting a return earlier will give accountants additional time to identify potential tax savings. There is a wide range of tax reliefs available to businesses and individuals .That includes R&D tax credits, relief on charitable donations, private pension contributions, and work expenses.

At Small Business Accountant, our highly qualified team of tax advisers have the specialist skills and knowledge. We offer you the assistance you need. We will help completing a late tax return to reduce any further penalties being incurred or advice on reducing tax liabilities for the future.

Please contact us on 02070784371 or just simply email us at info@small-business-accountant.org.uk. You also can fill up one of our quote forms , we will take you from there.